Stock market volatility can try the nerves of even the most seasoned investor. When markets decline, it's natural for you as an investor to want to preserve your assets. At Thielen & Associates, Inc., we have a depth of knowledge in navigating the cyclical markets we’ve experienced over the years. Here are ways to stay patient, stay the course, and let us advise you on ways to seize opportunities that market volatility creates.

Breathe – Don’t Panic – Financial markets are constantly in motion. We know the market will react, whether it’s a global pandemic, natural disaster, or geopolitical tensions. Volatile market activity is inevitable and part of the normal investing cycle. Rest assured that our team closely monitors activity directly related to your financial plan and is here to consult you.

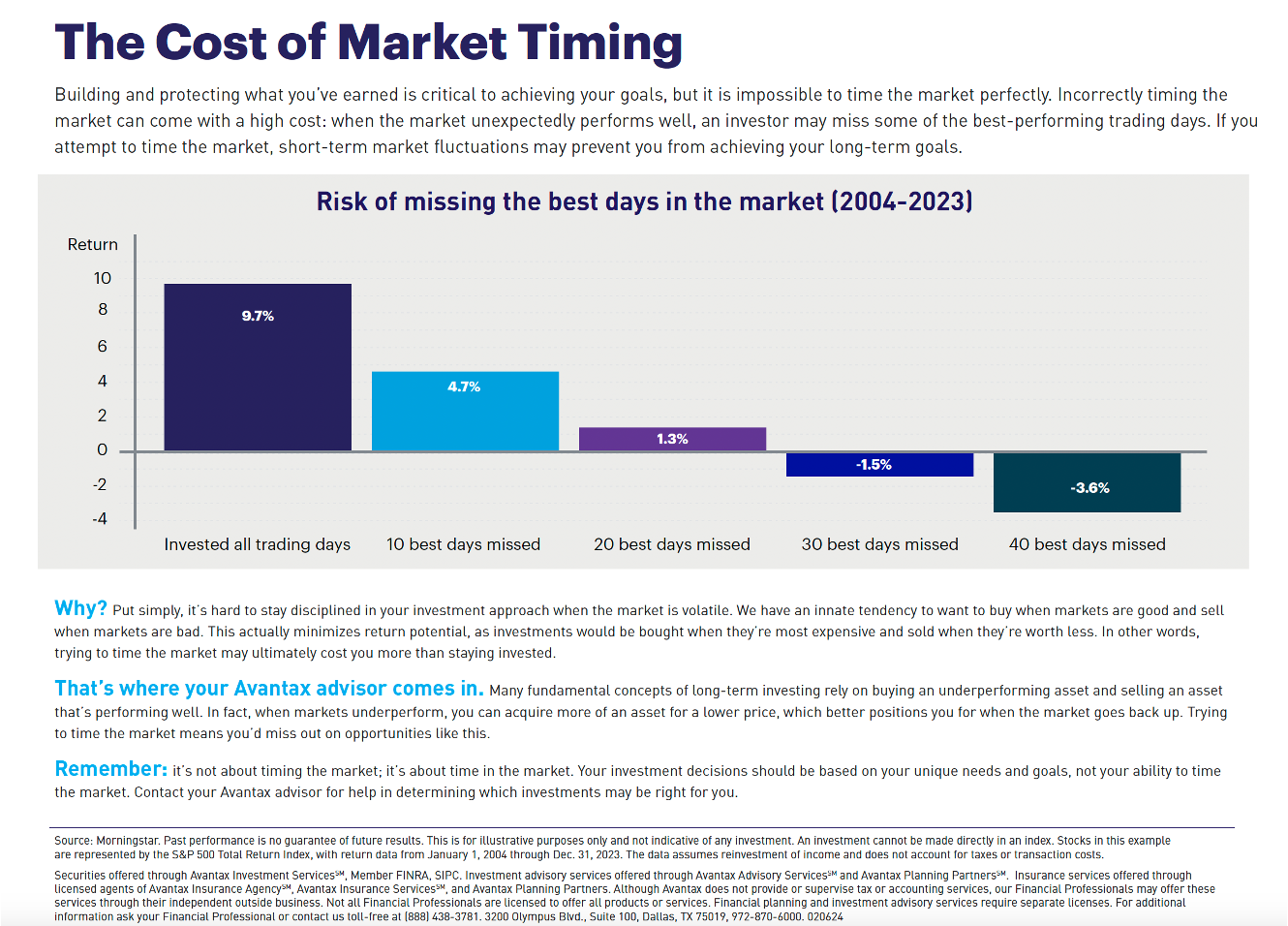

Avoid Timing Market – It’s common when investors see the first sign of a declining market to want to bail out and cash out. Put simply, it’s hard to stay disciplined in your investment approach when the market is volatile. We have an innate tendency to want to buy when markets are good and sell when markets are bad. This minimizes return potential, as investments would be purchased when they’re most expensive and sold when they’re worth less. In other words, trying to time the market may ultimately cost you more than staying invested.

…this is where our team comes in. Many fundamental long-term investing concepts rely on buying an underperforming asset and selling an asset that’s performing well. In fact, when markets underperform, you can acquire more of an asset for a lower price, which better positions you for when the market goes back up. Trying to time the market means you’d miss out on opportunities like this.

It's important to remember it’s not about timing the market but time in the market. Your investment decisions should be based on your unique needs and goals, not your ability to time the market.

Importance of Having a Financial Plan

Having a financial plan in place during market volatility can help give you and our team a better idea of how to meet your long-term goals. Your financial plan should change, adapt and be dynamic just as life changes, as do your circumstances. Maybe you’re in a new tax bracket, recently divorced, decided to start a family, or received an inheritance. These examples affect you personally, and your financial plan should be the roadmap that keeps you on course.

Your portfolio and financial plan depend on you and your goals, but the harsh reality is that the stock market doesn’t know who you are, isn’t aware of your risk tolerance, and doesn’t personally care about your goals. Therefore, utilizing your financial plan to guide you through times of volatility and the resources you have around you can help you stay on track and silence the trends and noise that could easily pull you back from staying focused on your goals.

If you don’t have a financial plan in place, I encourage you to reach out to our team so that we can work together to create one. The plan we develop together will include more than just an investment strategy but will also consider all areas of your personal finances, so we aren’t missing opportunities to meet your current and future needs.

At Thielen & Associates, Inc., we know the stock market is prone to fluctuations, and market volatility can cause you concern from time to time. We are staying focused on the long-term goals, the strategies of your unique financial plan, and the potential consequences of making knee-jerk, emotional reactions to market ups and downs.

Investments are subject to market risks including the potential loss of principal invested.